The financial landscape for Nigeria’s small business sector is set to undergo a transformation as nairaCompare, the nation’s top digital financial marketplace, partners with the Association of Small Businesses of Nigeria (ASBON). This collaboration merges nairaCompare’s innovative fintech solutions with ASBON’s extensive network of over 40,000 small business owners nationwide.

ASBON members will now have exclusive access to nairaCompare’s array of Providers offering loan, savings, and investment products tailored to empower small businesses, providing them with the necessary financial support to drive growth, innovation, and economic prosperity across Nigeria’s entrepreneurial ecosystem.

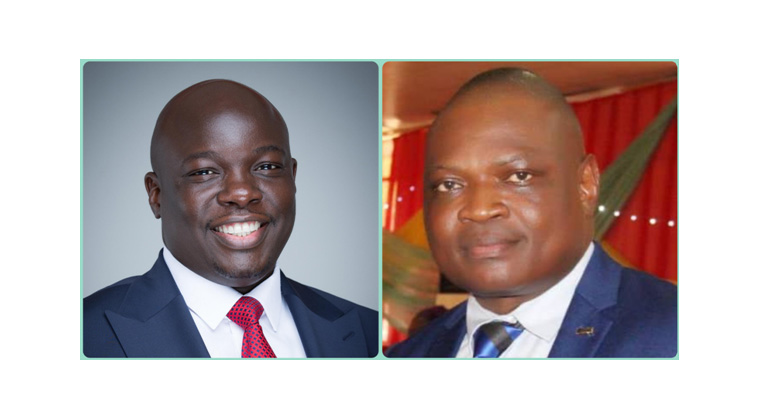

Expressing enthusiasm about the partnership, Achia Tor-Agbidye, Head of Growth and Customer Experience at Suretree Connect, highlighted the shared mission with ASBON to enhance financial inclusion and economic empowerment for Nigeria’s small business community. The collaboration aims to seamlessly provide Nigerians with essential financial tools and resources to thrive, unlocking opportunities for hardworking entrepreneurs.

Dr. Femi Egbesola, National Chairman of ASBON, echoed this sentiment, emphasizing the alignment between the partnership’s objectives and ASBON’s mission to empower members with resources crucial for navigating the challenges of running successful businesses.

One of the significant challenges faced by ASBON members is the limited access to finance, with many financial institutions hesitant to engage with micro and small businesses due to concerns over collateral or repayment risks. Through the partnership with nairaCompare, barriers to accessible financing options are overcome, providing tailored solutions to meet the unique needs and aspirations of ASBON members.

ASBON, a privately operated association advocating for Nigeria’s micro, small, and medium enterprises, has been instrumental in supporting the growth of small businesses across various sectors in the country. The association not only offers financial assistance to its members but also engages with policymakers and regulators to create a conducive environment for small businesses to thrive.

ASBON’s advocacy efforts have led to impactful initiatives, including tax reforms benefiting small businesses with a turnover of 25 million naira or less, and collaborations with government agencies to secure discounts for its members, promoting business growth and reducing operational costs.

The partnership between nairaCompare and ASBON signifies a significant stride towards fostering an inclusive and sustainable ecosystem for small businesses in Nigeria, ultimately driving economic growth, employment opportunities, and cultivating a vibrant entrepreneurial culture nationwide.

Empowering entrepreneurs through funding insights and opportunities, ASBON members leveraging the nairaCompare platform gain knowledge to make informed financial decisions for their businesses’ growth and long-term sustainability.

nairaCompare serves as a comprehensive financial comparison platform, assisting users in making informed decisions on loans, savings, and investments. By offering tailored evaluations based on key factors like interest rates and repayment terms, nairaCompare ensures users find suitable financial solutions. It is a product of Suretree Connect.

For small businesses navigating Nigeria’s complex financial landscape, nairaCompare simplifies the process by providing a one-stop shop to compare business loans from multiple lenders, matching users with the best options based on specific requirements.

Stop the endless search! Discover the ideal loan with nairaCompare!