Trading forex is gaining popularity in Kenya, but a significant number of traders (around 90%) end up losing money in the process.

For beginners, it is essential to identify safe and regulated forex brokers, understand their pricing structure, participate in free trading webinars, engage with authentic traders in Kenyan forex trading communities such as MyTradingLand.com, watch educational videos on platforms like YouTube, and more.

After conducting a thorough review of forex brokers operating in Kenya, we have curated a list of the top performers based on various criteria, starting from their regulatory status and reliability.

Top Forex Brokers in Kenya

Comparison of Leading Forex Brokers in Kenya

| 💼 Broker | 💰Minimum Deposit | ⚖️ CMA Regulated | 🎯 EUR/USD Spread | 💳 MPESA | ☎️Toll-free Telephone | 💬 Live Chat |

| Exness | 10 USD | Yes | 1 pip | Yes | No | Yes |

| HFM Kenya

|

700 KES | Yes | 1.6 pips | Yes | No | Yes |

| Pepperstone

|

None | Yes | 1.1 pips | Yes | No | Yes |

| FxPro

|

$100 | No | 1.26 pips | Yes | No | Yes |

| FxPesa

|

5 USD | Yes | 1.4 pips | Yes | Yes | Yes |

| Scope Markets

|

100 USD | Yes | 1.1 pips | Yes | No | Yes |

| FXTM

|

500 USD | Yes | 1.8 pips | Yes | No | Yes |

#1. Exness – The Best Overall Forex Broker in Kenya

Exness is officially registered with the Capital Markets Authority in Kenya under Tadenex LTD (license no. 162), ensuring close supervision and audit by the Kenyan government. Approximately 78.33% of retail traders tend to lose money while trading CFDs with Exness.

Continue reading to discover why Exness secured a spot on our list of the best forex brokers in Kenya.

Exness Beginner Accounts

| 🏘️ Available Beginner Account Types | Cent Account & Standard Account |

| 💵Minimum Deposit | $10 (1,270 KES) |

| 💸EUR/USD Spread | 1.0 pips |

| 💰Commissions | $0 |

| 🛒CFD Markets (Cent Account) | Forex & Metals |

| 🛒CFD Markets (Standard Account) | Forex, Stocks, Indices, Metals, Energies |

| 🚀Leverage | 1:400 |

| 📈Platforms | MT4, MT5, Exness Web, Exnes Mobile |

Cent Account: Tailored for novices with a minimal $10 deposit and restrictions on high-risk instruments to safeguard new traders. Only Forex & Metal CFDs are tradable here, with spreads typically starting at 1.0 pips and no commissions.

Standard Account: Geared towards beginner and retail traders with a $10 minimum deposit and access to all Exness instruments. Similarly, this account offers 1.0 pips spreads with no commission charges.

The Standard Account does not involve commissions, making it beginner-friendly.

Exness Accounts for Professionals

| 🏘️ Available Professional Account Types | Pro, Raw Spread, & Zero Spread |

| 💵Minimum Deposit | $500 (63, 600 KES) |

| 💸EUR/USD Spread | 0.0 pips |

| 💰Commissions | $3.5 per side & above |

| 🛒CFD Markets | Forex, Stocks, Indices, Metals, Energies |

| 🚀Leverage | 1:400 |

| 📈Platforms | MT4, MT5, Exness Web, Exnes Mobile |

PRO, Raw Spread, & Zero Spread Accounts: Designed for professional traders handling larger volumes.

These accounts necessitate a $500 minimum deposit, offer reduced trading costs, spreads as low as 0.0 pips, and levy additional commissions from $3.5 per side (excluding the commission-free Pro Account, which boasts instant trade execution, spreads from 0.1 pips).

Exness Kenya Broker Summary

- Exness operates as a non-dealing forex broker under CMA regulation in Kenya, ensuring they do not trade against clients to avoid conflicts of interest. They act solely as intermediaries in trades.

- The minimum deposits are $10 for the Standard Account and $500 for the Professional Account at Exness.

- Established in 2008 (over 16 years ago), Exness is a reputable broker with a global presence, but it does not accept traders from Europe and the USA. However, clients from various African countries, including Kenya, Uganda, Tanzania, and South Africa, are welcome to trade with Exness.

- Exness maintains a solid reputation as a trustworthy forex broker without any significant controversies or scandals in its history.

In various regions, entities follow regulatory guidelines. For instance, in Kenya, they adhere to CMA regulations, while in South Africa, they possess an ODP license from the FSCA.

If you desire more detailed information, please refer to our comprehensive Exness Review

| 👍 Pros | 👎 Cons |

| Practice trading with a demo account without risking real money | Limited product portfolio, primarily focused on forex instruments |

| Ability to hold an account in KES currency | No deposit bonuses offered |

| Regulated by CMA in Kenya | |

| No overnight or inactivity fees | |

| Offers lower spreads compared to many other brokers | |

| 24/7 customer support available | |

| Supports MPesa deposits and withdrawals | |

| No withdrawal charges |

Explore further insights about Exness Kenya on their official website

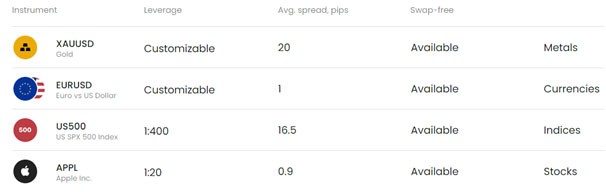

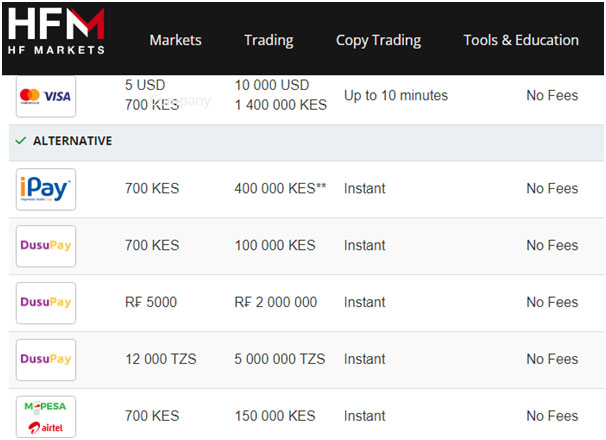

#2. HFM Kenya – Optimal MPESA Deposit & Withdrawal Terms

Previously known as Hotforex, HF Markets commenced operations in 2010 under the HFM brand. Licensed by the Kenyan Capital Markets Authority (CMA) as a non-dealing forex broker with license number 155. The majority of retail traders, about 73.30%, experience losses when trading CFDs with HF Markets.

HFM Accounts for Beginners:

| 🏘️ Beginner account types | Cent Account, Premium Account |

| 💵Minimum deposit | 700 KES |

| 💸EUR/USD Spread | 1.4 pips |

| 💰Commissions | $0 on forex, $0.1 on Stocks/ETFs |

| 🛒CFD Markets (Cent Account) | Forex & Metals |

| 🛒CFD Markets (Standard Account) | Forex, Metals, Indices, Energies, Stocks, Bonds, ETFs, Agriculture |

| 🚀Leverage | 1:400 |

| 📈Platforms | MT4, MT5, HFM App |

Cent Account: Intended for novices cautious about risking substantial capital. It entails a minimum deposit of $5 (approximately 700 KES), no commissions on Forex trades but applicable on other instruments, and offers a leverage of 1:400.

| 🏘️ Types of Professional Accounts | Razor Account |

| 💵Minimum Deposit | $0 |

| 💸EUR/USD Spread | 0.1 pips |

| 💰Commissions | $3.5 per side (for currency trades only) |

| 🛒CFD Markets | Forex, Commodities, Indices, Shares, ETFs |

| 🚀Leverage | 1:400 |

| 📈Platforms | TradingView, cTrader, MT4, MT5 |

Razor Account: The Razor Account is tailored for trading high volumes, providing transparent and low ECN spreads. The average spread for EUR/USD is 0.1 pips, while GBP/USD and USD/CAD have spreads of 0.4 pips. In this account, you incur commissions of up to $3.5 per side when trading currency pairs exclusively.

The Pepperstone Razor Account imposes no minimum deposit requirement, allowing you to start trading with any amount of your choice.

Pepperstone Kenya Broker Summary

- Regulated by the CMA in Kenya, Pepperstone operates as a non-dealing forex broker.

- Established in Australia in 2010, Pepperstone boasts a global presence with licenses from reputable regulators in the UK, Germany, Dubai, and more.

- In Kenya, Pepperstone does not mandate a minimum deposit. Traders need to check the margin requirement for the specific instrument they wish to trade, deposit slightly above that amount, and begin trading.

- Pepperstone Kenya accepts local funding methods such as MPESA and international methods like PayPal.

| 👍 Pros | 👎 Cons |

| Regulated by the CMA Kenya | KES base currency not supported on Pepperstone |

| No minimum deposit and no inactivity fees | Incurs overnight fees |

| Competitive spreads aligned with industry standards | |

| Accepts MPESA and PayPal for transactions in Kenya | |

| TradingView platform available for Razor Account users | |

| Offers demo accounts and supports MetaTrader tools |

Further details about Pepperstone Kenya can be found on their official website.

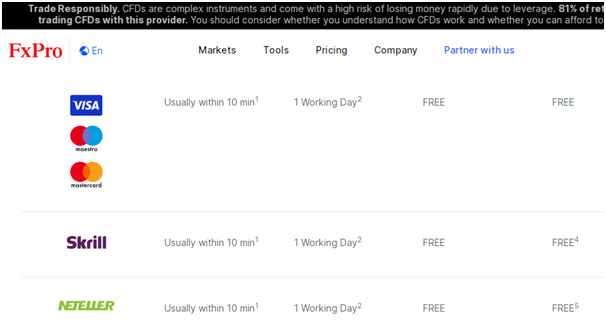

4. FxPro – Forex Broker with the Best Education

While FxPro accommodates Kenyan traders, it operates without regulation from the CMA, exposing traders to trade without the protection of Kenyan laws. Overseas, FxPro is regulated by the Securities Commission of the Bahamas, and accounts are governed by Bahamian business laws.

81% of retail traders experience financial losses when trading CFDs with FxPro.

FxPro Accounts for Beginners

| 🏘️ Beginner Account Types | Standard Account |

| 💵Minimum Deposit | $100 |

| 💸EUR/USD Spread | 1.5 pips |

| 💰Commissions | $0 |

| 🛒CFD Markets | Forex, Shares, Energies, Indices, Futures, Metals |

| 🚀Leverage | 1:200 |

| 📈Platforms | cTrader, MT4, MT5, FxPro Mobile, FxPro Web |

Standard Account: The Standard Account requires a minimum deposit of $100, with an average EUR/USD spread of 1.5 pips. This account type does not charge commissions, making it suitable for beginners.

When opening an MT5 Standard Account, you can set it up for either hedging or netting strategy execution, particularly useful for trading Stock CFDs.

Beginners at FxPro have access to educational resources through the FxPro Knowledge Hub, which includes:

- Video tutorials in the Watch & Learn section on using FxPro apps and platforms

- CME Group Education offering trading education from the Chicago Mercantile Exchange

- Forex articles

- Trader psychology insights

FxPro Accounts for Professionals

| 🏘️ Professional Account Types | Raw+ Account, Elite Account |

| 💵Minimum Deposit | $500 |

| 💸EUR/USD Spread | 0.2 pips |

| 💰Commissions | $3.5 per side |

| 🛒CFD Markets | Forex, Shares, Energies, Indices, Futures, Metals |

| 🚀Leverage | 1:200 |

| 📈Platforms | cTrader, MT4, MT5, FxPro Mobile, FxPro Web |

Raw+ Account: This account type requires a minimum deposit of $500, featuring an average EUR/USD spread of 0.2 pips. Commissions of $3.5 per side apply to Forex and Gold trades on the FxPro Raw+ Account. When setting up an MT5 Raw+ Account, you can configure it for hedging or netting strategies as well.

Elite Account: This account offers rebates for high-volume traders, but it requires an initial deposit of $30,000 within 2 months. The commission/spread structure mirrors that of the Raw+ Account.

FxPro Broker Summary

- FxPro lacks regulation in Kenya but maintains a reputable international standing.

- Established in 2006, FxPro holds licenses from various regulators, affirming its legitimacy.

- The minimum deposit at FxPro is $100.

- MPESA is accepted, and withdrawals usually process within 1 working day, barring delays from banks.

| 👍 Pros | 👎 Cons |

| Support for MPESA transactions | Lack of regulation by CMA Kenya |

| Wide range of platforms available | Absence of KES base currency |

| Diverse selection of tradable instruments | $10 inactivity fee |

| No withdrawal fees | Incurs overnight fees |

| Access to demo accounts | Higher spreads |

| Educational content through FxPro Knowledge Hub |

Learn more about FxPro Kenya by visiting their official website.

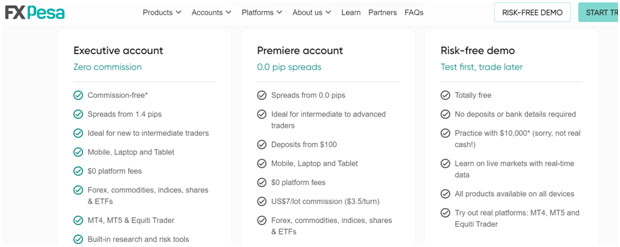

5. FxPesa – Broker with Premier Customer Support

FxPesa is under the EGM Securities Ltd. company group, a registered entity in Kenya since 2012. Regulated by the Capital Markets Authority in Kenya, FxPesa operates as a non-dealing online forex broker with license number 107.

63.3% of retail traders face losses when trading CFDs with FXPesa. Discover why FXPesa earns a spot on our list of top forex brokers in Kenya.

Beginner’s Guide to Accounts

Standard Account: This account uses KES & USD as base currencies and has no minimum deposit requirement. It offers zero commission on trades with spreads starting at 1.4 pips. The maximum leverage is 1:400, and the Executive account is accessible on MT4, MT5, and Equiti trader across all platforms.

FXPesa Accounts for Professionals

Premier Account: The Premier Account features spreads as low as 0.0 pips, requires a minimum deposit of 100 USD, and charges a commission of $3.5 per side. It offers a maximum leverage of 1:400. FxPesa accepts various payment methods including M-Pesa, EazzyPay, and mobile money from Uganda (MTN & Airtel) and Tanzania (Vodacom, Airtel TZ, HaloPesa, TigoPesa). Additionally, credit card deposits and withdrawals using MasterCard and VISA in KES are available. Bank transfers in KES or USD are also accepted.

All deposit methods are instant, but FXPesa withdrawals take 2 working days. While international bank transfers incur a fee of 15 USD, there are no fees for other deposit and withdrawal methods except an inactivity fee equal to three basis points plus the SOFR 30-day rate after 180 days of inactivity.

Fxpesa provides toll-free help lines in Kenya, ensuring easy access to customer support. Moreover, their responsive live chat and timely social media responses enhance customer service. The platform’s fees are reasonable without excessive charges.

FXPesa Broker Summary

- No minimum deposit requirement for the entry-level Standard Account

- FXPesa is a licensed broker by the CMA, establishing its legitimacy in Kenya

- To create an FXPesa account, visit their website, click on “start trading,” fill in your contact details, phone number, and upload your Kenyan government ID. Further information about FxPesa can be found on their website

| 👍 Pros | 👎 Cons |

| Excellent customer support with toll-free telephone lines for Kenya | No waivers on overnight fees |

| No minimum deposit required for Standard Accounts | Inactivity fees |

| Demo account and educational resources for beginners | High spreads |

| Regulated by CMA | 1% Withdrawal fees for Neteller and Skrill |

| KES base currency | – |

| Support for local funding methods like MPesa | – |

| Accepts deposits in USD, KES, TZS, and UGX | – |

| Copy trading | – |

#6. Scope Markets – Trusted CMA Regulated Forex Broker in Kenya

- CMA regulated: Yes

- Operating in the forex industry for over a decade: Yes

SCFM Limited, operating as Scope Markets, is a non-dealing online forex broker founded in 1997. Regulated and licensed by the Capital Markets Authority (CMA) under license number 123.

Scope Markets Account Types– The Silver Account is commission-free, uses KES and USD, and requires a minimum deposit of 100 USD. The Gold Account operates in KES and USD with a 100 USD minimum deposit. A Demo Account is available for beginners to practice trading with virtual funds.

Scope Markets Funding methods– Funding methods at Scope Markets include Cards, e-Wallets, and Mobile money channels like M-Pesa, Airtel, Equitel, and PesaLink.

- MPesa accepted? Yes

- eWallet payment accepted? Yes

- Card payment accepted? Yes

- Bank transfer accepted? Yes

- Cryptocurrency accepted? No

Scope Markets Fees– Scope Markets offers competitive spreads with an average of 1.1 pip on the Silver Account for EUR/USD and 0.2 pip on the Raw spread Gold Account, aligning with industry standards. There are no fees for deposits or withdrawals, but subsequent withdrawals after one free daily withdrawal incur a charge of 35 USD/35 EUR/35 GBP. An inactivity fee of 10 USD is applied after 6 months of account dormancy, and no swap fees are charged on major currency pairs.

- Deposit fees? No

- Withdrawal fees? Yes

- Swap fees on major currency pairs? No

- Swap fees on minor currency pairs? Yes

- Inactivity fee? Yes

General Trading Conditions– Scope Markets enables trading in CFDs on 60+ Currency pairs, Shares, Indices, Commodities, and Nairobi Stock Exchange (NSE) Derivatives. The platforms available are MT5, Scope copy, and Scope mobile trader.

| 👍 Pros | 👎 Cons |

| Regulated by CMA | High minimum deposit of 100 USD |

| No swap fees on major currency pairs | Withdrawal fees |

| Competitive spreads compared to industry averages | Fewer asset classes in the CFD instrument menu than competitors |

| NSE Derivatives trading available on Scope Markets Kenya | No MT4 platform |

| Demo Account | Inactivity fees |

| KES base currency at Scope Markets | No 24/7 live chat support |

| MPesa transactions accepted by Scope Markets | – |

For more details about Scope Markets Kenya, visit their website.

Key Considerations for Choosing a Forex Broker in Kenya

Traders in Kenya should evaluate several factors when selecting a forex broker. Below are essential aspects to consider:

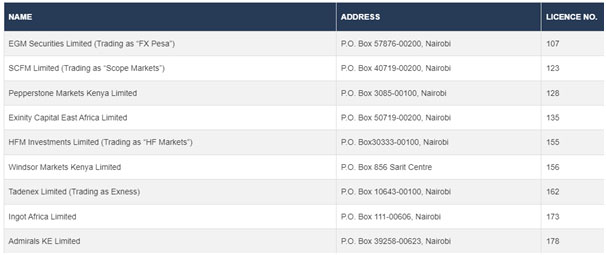

1. CMA Regulation – Ensure the forex broker is regulated by the appropriate authorities.

Financial regulatory agencies in most countries provide licenses to brokers, subject to meeting specific criteria that ensure their reliability. Regulation ensures brokers adhere to industry best practices while safeguarding traders’ interests.

Trading with a licensed broker protects your investments, and regulatory bodies can intervene if issues arise. It also reduces the risk of falling victim to fraudulent schemes by unlicensed brokers.

Check the Capital Markets Authority (CMA) website for the updated list of licensed brokers.

The list is regularly updated to reflect changes in licensed brokers, including new additions or suspensions.

2.The base currency in forex trading refers to the currency allowed for use in your account. It is the legal tender of your account and all transactions are conducted through it.

Once you have selected a base currency for your account, it cannot be changed. The only option available is to open a new trading account with a different base currency. The choice of base currency is crucial as it determines your margin requirements and cash accounts. It is advisable to ensure that your forex account’s base currency is in your home country’s currency.

For instance, if you are from Kenya and your forex account’s base currency is USD, any deposits made in KES will be converted to USD, incurring currency conversion fees. The same applies when making withdrawals, requiring a conversion from USD to KES, which can eat into your trading funds.

On the other hand, having your base currency in KES can help save on conversion fees, allowing you to utilize those funds for trading purposes. It is important to verify if the broker offers a base currency in your home country’s currency before opening an account.

Currency pairs compare the value of two different national currencies against each other in forex trading. They are expressed using currency codes, such as USD for the United States Dollar, and are presented as pairs like GBP/USD, EUR/USD, JPY/CHF, KES/USD, etc.

Having a wide range of currency pairs available with your broker provides flexibility in trading and risk management. Major pairs like EUR/USD are highly liquid and widely traded, while exotic pairs may be less liquid and more volatile. Commodity currencies like NZD, AUD, and CAD are influenced by their countries’ export commodities.

A reputable broker should offer multiple trading platforms compatible with various devices, including mobile apps for convenient trading on-the-go. Diverse trading platforms allow you to monitor trades efficiently across different devices and access unique features tailored to each platform.

Forex brokers charge various fees, such as trading commissions, spreads, deposit and withdrawal fees, and overnight swap fees. These fees impact your trading capital and profits. When selecting a broker, consider their fee structure and opt for those with tight spreads or zero spreads on preferred currency pairs.

Additionally, brokers may impose commissions on trades and swap fees for holding positions overnight, based on interest rate differentials between currency pairs. It is essential to understand these fees and factors influencing them before trading with a broker.

A reliable broker should offer multiple payment methods for deposits and withdrawals, including local payment channels like MPesa for easier and cost-effective transactions.

Ensure you assess these key factors when choosing a forex broker to optimize your trading experience and financial outcomes.

What is a Forex Broker?

An entity that facilitates currency trading for individuals is known as a forex broker. Typically, a retail forex broker can be an individual or organization that offers a platform for trading in the forex market.

Legality of Forex Trading in Kenya

Forex trading is indeed legal in Kenya, with the government authorizing the Capital Markets Authority (CMA) to issue non-dealing forex licenses to eligible brokers wishing to conduct business in the country.

Understanding Forex Leverage in Kenya

In Kenya, the Capital Markets Authority (CMA) mandates all forex brokers to adhere to a maximum leverage limit of 1:400. Brokers offering leverage above 1:400 are not regulated by the CMA.

Notable Forex Brokers in Kenya

While there is no definitive “best” forex broker, Exness, HF Markets, and FXPesa are recognized as reputable options in Kenya. These brokers boast over a decade of industry experience, support deposits and withdrawals in Kenyan shillings, and facilitate transactions in local currencies. Additionally, they offer commission and spread-free accounts to accommodate various trading preferences, along with demo accounts for practice.

Forex Brokers Accepting M-Pesa in Kenya

Among the forex brokers accommodating M-Pesa transactions in Kenya are FXPesa, Pepperstone, HF Markets, Exness, Scope Markets Kenya, and XM brokers. HF Markets is particularly recommended for its M-Pesa integration.

Best Forex Broker for Small Accounts in Kenya

For individuals with small trading accounts, HFM (formerly Hotforex) emerges as the top choice in Kenya. HFM Kenya offers a Cent Account tailored for trading micro-lots, with a minimum deposit requirement of 700 KES.

Identifying Legitimate Forex Brokers in Kenya

To verify the legitimacy of a forex broker, visit the CMA website and access their list of licensed entities. Brokers not featured on this list but catering to Kenyan clients pose a higher risk of engaging in fraudulent activities.

Forex Brokers with Lowest Minimum Deposits in Kenya

HFM Kenya boasts the lowest specified minimum deposit of 700 KES, while Pepperstone and FXPesa do not enforce minimum deposit requirements.

Scam Awareness Among Forex Brokers in Kenya

Regrettably, instances of forex broker-related scams have been reported in Kenya, often involving phishing tactics. It is advisable to steer clear of unlicensed brokers to mitigate the risk of falling victim to such scams.