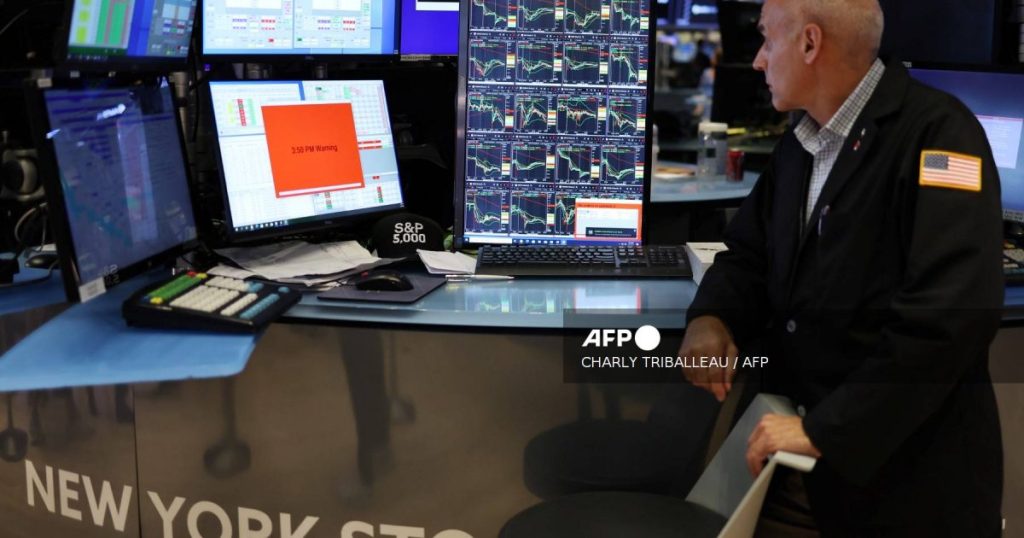

After experiencing three consecutive days of losses, Wall Street stocks made a recovery on Tuesday. Analysts attribute this rebound to bargain hunting and a bounce in the US bond markets.

Following a relatively calm day in most international stock markets, the gains in New York were spurred by strong earnings reports from Caterpillar and Uber, which lifted the shares of both companies.

Jack Ablin of Cresset Capital expressed optimism, stating, “I’m hopeful that we’ll get some stability back.” However, he also noted that there may still be “a little more downside risk to the market.”

The Dow Jones Industrial Average closed up 0.8 percent at 38,997.66.

The broader S&P 500 saw a 1.0 percent increase, reaching 5,240.03, while the tech-heavy Nasdaq Composite Index also rose by 1.0 percent to 16,366.85.

On Monday, major indices had fallen by over 2.5 percent, reflecting concerns about a potential US recession following disappointing job data released on Friday.

Market analysts also highlighted the repercussions of Japan’s recent decision to raise interest rates, which led to a strengthening of the yen and triggered sell-offs in other markets.

The Nikkei, which had plunged by 12.4 percent on Monday, rebounded with a 10.2 percent surge on Tuesday.

The shift in the US equity market was accompanied by a rise in US Treasury bond yields and a decrease in a closely-monitored volatility index.

Noteworthy performers among individual companies included Caterpillar, which saw a 3.0 percent gain following better-than-expected profits driven by strong pricing that offset revenue reductions.

Uber experienced a significant 10.9 percent surge after reporting higher profits due to a 16 percent increase in revenues to $10.7 billion. Company executives attributed this success to robust demand from frequent users.

AFP