After a proactive investigation by the Met’s Cyber Crime Unit (CCU), 23-year-old Dan Aiyegbusi from Eastern Boulevard, Leicester, has been handed a five-year sentence at Southwark Crown Court in the UK.

He confessed to never having worked and admitted to colluding with organized hackers in the UK and internationally to launder stolen money.

Prior to this, Aiyegbusi had pleaded guilty to five separate counts of money laundering amounting to £41,150 and possession with intent to supply Class A drugs (crack cocaine) and Class B drugs (cannabis). He was also sentenced for the crack cocaine and cannabis supply, both of which were also investigated by the Met’s Cyber Crime Unit.

Although he pleaded not guilty to three counts of money laundering totaling £2,167,410, he was found not guilty in relation to these other counts following a trial at Southwark Crown Court in December 2019.

During the trial, it came to light that prior to his arrest for money laundering by the Met’s Cyber Crime Unit, Aiyegbusi had been apprehended by officers from Essex Police in Colchester and was found in possession of 49 rocks of crack cocaine.

While in custody, Met officers investigating him for the cyber-crime offenses gained access to other mobile phones controlled by him, containing evidence of his involvement in the county lines supply of Class A drugs.

The court also learned that in April 2018, a Facebook account under the name of ‘Miyuwa Oluwafemi’ – a pseudonym used by Aiyegbusi, was identified. The account was being used to advertise compromised online bank accounts acquired through cyber-dependent crime such as ‘phishing’.

Further investigation revealed that the Facebook account, opened in 2015, contained requests for banks accounts or credit/debit cards for use in fraud. It also contained photos and videos of compromised online bank accounts being emptied of funds, as well as incriminating posts to attract individuals to provide their bank accounts for his online fraud operation.

An undercover operation, known as Operation Katoko, was launched to identify Aiyegbusi and gather evidence of the criminal activities. The operation uncovered posts that identified victims and a partnership with TSB and Barclays banks assisted in identifying nine victims between July 2017 and January 2019. More potential victims across the country are believed to have been targeted by Aiyegbusi.

In June 2019, substantial evidence was gathered against Aiyegbusi, leading to his arrest in Luton on 26th June 2019.

Upon searching his property and vehicle, officers found large amounts of cannabis and electronic devices containing incriminating evidence, leading to Aiyegbusi pleading guilty to possession with intent to supply Class B drugs (cannabis).

He was charged with eight counts of money laundering, related to cyber-related fraud committed against members of the public who had online bank accounts, as well as possession with intent to supply Class A drugs (cocaine from the Essex investigation) and possession with intent to supply Class B drugs (cannabis).

Detective Inspector Phil McInerney of the Met’s Central Specialist Crime – Cyber Crime Unit commented, “Aiyegbusi admitted in court that he had never worked a day in his life, instead acquiring huge sums of money from innocent members of the public through large-scale cyber-enabled fraud committed across the UK banking sector. I would like to thank our partners in the banking sector and the Cyber Defence Alliance for their support and assistance during this investigation.”

One of Aiygebusi’s 80-year-old victims expressed relief at the news of his sentencing, recalling the stress and worry caused by fraudulent telephone calls claiming to be from a telephone company.

Barclays and Cyber Defence Alliance CEO, Steve Wilson, also praised the coordinated efforts with law enforcement in combating organized cyber crime.

Ashley Hart, Head of Fraud at TSB Bank PLC, commended the collaboration with the Metropolitan Police Service in apprehending the criminal responsible for the fraud and illicit activities.

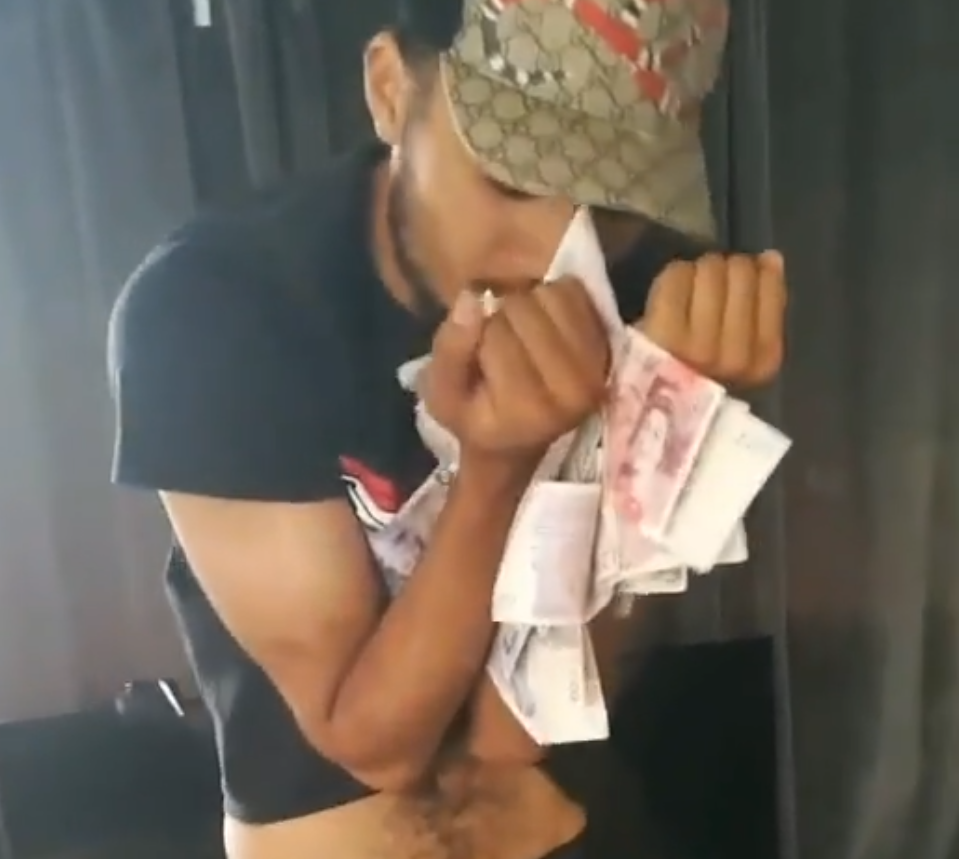

Watch video of Aiyegbusi kissing cash